iedge s reit

Fear of rising rates The key reason that is causing REIT prices to fall is the anticipation of the rise in interest rates. What I dont like about this is theres no track record for this ETF.

Csop Iedge S Reits Leaders Index Etf Riding The Wave With S Reits Leaders Youtube

Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet.

. The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust. Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC. The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index the Index.

Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. SGX-ST Main Board. The latest 12-month dividend yield is at 408 as of 31 October 2021.

Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. Online subscription for the ETF is now open during the Initial Offer Period IOP online from 29 October 2021 till 15 November 2021 by 930am. The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index the Index.

In terms of sustainability of its yield from my understanding the iedge s-reit leaders index is projected to deliver a growth of 593 and a yield of 543 in 2022 according to bloomberg terminal as at 30 september 2021 and highlighted in rectangular boxes below and as the csop iedge s-reit leaders etf tracks the performance of this index. IEdge S-REIT Index - Singapore Exchange SGX We use cookies to ensure that we give you the best experience on our website. If you click Accept Cookies or continue without changing your settings you consent to their use.

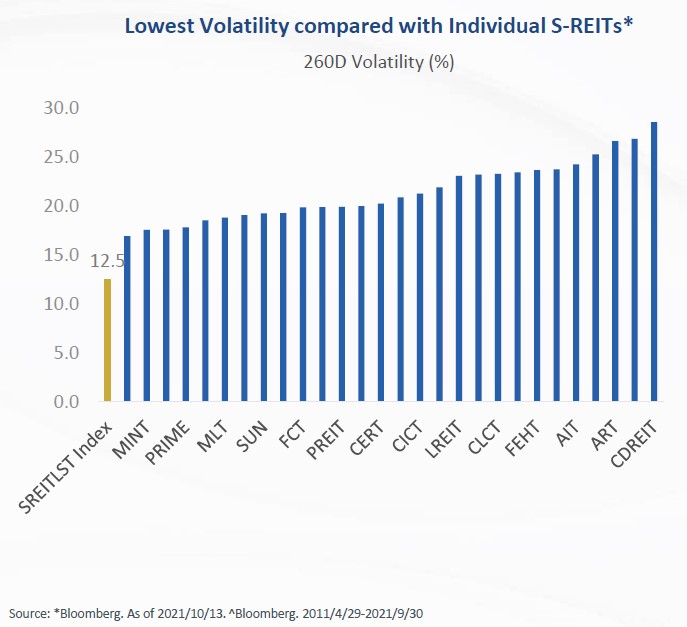

The ETF has several unique characteristics which stand out in particular. The iEdge S-Reit Index maintained resilience with a 2 per cent decline in total returns while the FTSE EPRA Nareit Developed Index a benchmark for global Reits declined 15 per cent. 10 Units or such other number of Units as the SGX-ST may.

Trading Board Lot Size. IEdge S-REIT Leaders Index. Not too bad for buying a diversified REIT ETF.

CSOP iEdge S-REIT Leaders Index ETF factsheet Which means this Singapore REIT ETF projects to pay a higher dividend yield of 53. For the quarter-to-date Singapore stocks have seen S105 billion of net institutional outflows reducing the 2022 year-to-date YTD net institutional inflow to S74 million. CSOP iEdge S-REIT Leaders Index ETF Photo.

If we assume dividends are not reinvested the returns would have been 431. The CSOP iEdge S-REIT Leaders Index ETF is a sub-fund of the CSOP SG ETF Series I a Singapore unit trust. The latest 12-month dividend yield is at 408 as of 31 October 2021.

It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396. The suite comprises the iEdge S-Reit index widely regarded as one of S-Reits barometers and a narrower subset of it the iEdge S-Reit Leaders Index. SGX Counter Name Code.

CSOP iEdge SREIT ETF S SRT Secondary Currency. With the soon to be listed CSOP iEdge S-REIT Leaders Index ETF investors will now be able to invest in S-REITs via an ETF to reap its diversification benefits. Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested.

To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy. Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. The iEdge S-REIT Index made up of 37 REITs listed on the SGX was down 3 from a year ago or 9 from its peak in Jul 2021.

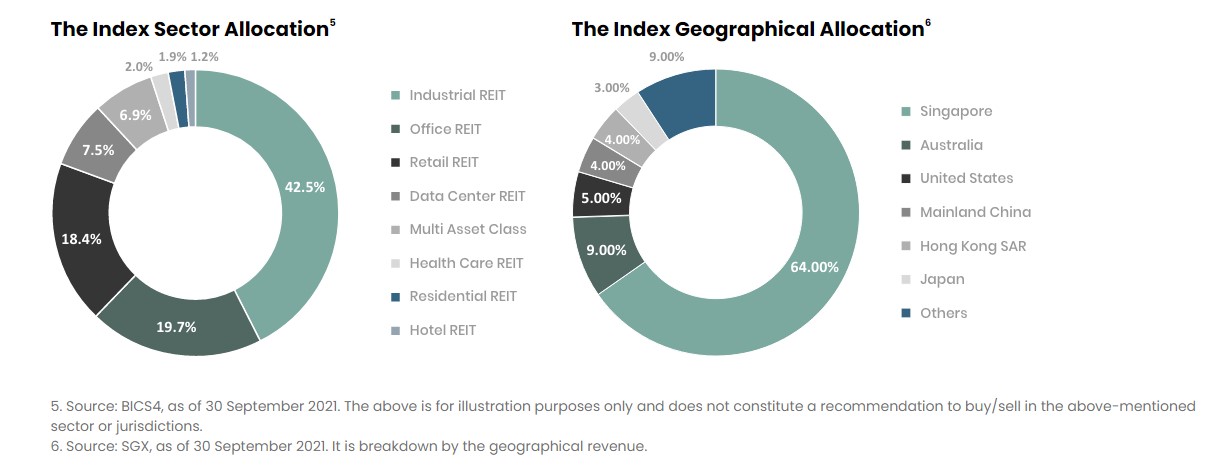

It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. S-REIT News - Read the latest S-REIT breaking news stay updated on business news investment company news stocks S-REIT news only on The Edge Singapore. Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX.

View stock market news stock market data and trading information. The fund tracks the performance of the iEdge S-REIT Leaders Index which mostly comprises S-REITs. Select REIT Index index overview by MarketWatch.

CSOP iEdge SREIT ETF US SRU. The funds manager applies an indexing-investment strategy or passive management to track its performance. If we assume dividends are not reinvested the returns would have been 431.

You can change your settings at any time. IEDGE S-REIT INDEX REIT REIT SGX See more on advanced chart 12958708 D SGD 116420 089 Market Closed as of Jun 10 1929 GMT8 13075128 Prev 13009298 Open NA Volume 12924779 13009298 Days Range Overview News Ideas REIT Chart 1D 5D 1M 3M 6M YTD 1Y 5Y All log Trade REIT with trusted brokers on TradingView Open account Ideas. The iEdge S-Reit Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid trusts in Singapore.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. To learn more about how we collect and use cookies and how you configure. DWRTF A complete Dow Jones US.

Business Wire A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate. The performance has not been bad if we compare it to the US or China equities. The ETF has several unique characteristics which stand out in particular.

After paying its expense ratio of 06 thats about 47. The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust.

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf To List On Sgx

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

S Reit Report Card Here S How Singapore Reits Performed In Fourth Quarter 2019

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Comments

Post a Comment